Some States May Tax Forgiven PPP Loan Proceeds

By Charles Jeane, Assistant Chief Counsel

‘Tis better to have a loan and be taxed than to never have had the loan at all. Tennyson and taxpayers with forgiven PPP loans who live in states that choose to tax those forgiven loans surely will not agree with that musing, but it is a dilemma that many small businesses across the country may face.

The Paycheck Protection Program (PPP) was part of the $2.2 trillion CARES Act passed by Congress in March 2020 to help keep small businesses afloat during the current pandemic. If PPP loan proceeds are used for qualifying costs – payroll; health insurance for paid sick, medical, or family leave; mortgage interest payments; rent; and utility payments – and 60% of the loan proceeds are used for payroll costs, then the federal government will forgive the loan. While a loan does not generate taxable income, a forgiven loan generally does. Congress addressed, to a degree, that issue by specifically stating in the CARES Act that forgiven PPP loans are not includable in taxable income. I addressed in an earlier article the issue of the deductibility of business expenses paid with forgiven PPP loan proceeds, which as of the date of this article has not been resolved.

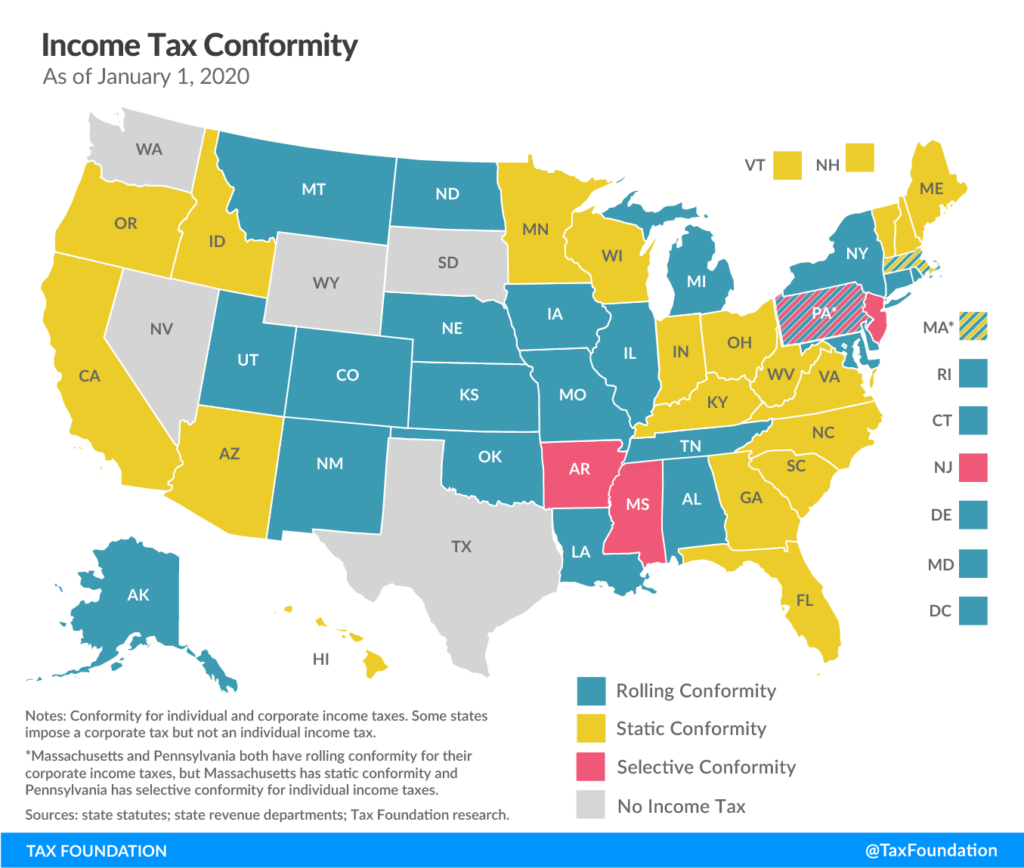

Enter the states. Each state that implements an income tax has its own revenue code that conforms in some degree to the IRC. Twenty-one states and the District of Columbia are rolling conformity states, meaning they automatically conform to the most current Internal Revenue Code (IRC) for both individual and corporate income taxes. Taxpayers with forgiven PPP loans in those jurisdictions will most likely exclude the forgiven loan proceeds from taxable income at the federal and state level, but it is not a guarantee. According to Jared Walczak, Vice President of State Projects with the Center for State Tax Policy at the Tax Foundation, a state could argue that it only conforms to the definition of gross income expressly stated in the IRC. While the CARES Act modified what is included in gross income, i.e., forgiven PPP loans proceeds, the Act did not specifically amend the IRC. Nineteen states are static conformity states, meaning that state lawmakers must vote to change their state’s conformity date (see the Tax Foundation Income Tax Conformity Map below). [1] These dates vary greatly; for example, California’s conformity date is 2015, Wisconsin’s is 2017, [2] and Virginia’s is 2019.[3] Static conformity states, unless they have passed legislation to conform to the most recent version of the IRC or the provisions of the CARES Act, are technically not in conformity with exempting forgiven PPP loans from gross income. Most states that have a state income tax use either federal adjusted gross income or taxable income as the starting point for calculating state taxable income. Because of this, it appears that states would have to take some affirmative action, e.g., changing forms or worksheets, to include forgiven PPP loans in taxable income for state income tax purposes. A Tax Foundation survey has projected that state revenues could be down $121 billion over the next two years. Because of the pandemic, states are hurting for revenue and may take the affirmative steps to tax forgiven PPP loans. Many states have not announced how they will proceed.

A lack of conformity increases compliance costs, especially for business taxpayers who tend to have more complicated tax returns than individuals. These increased compliance costs and the possibility of state taxation of a forgiven PPP loan, coupled with the IRS’s position that normally deductible business expenses paid with forgiven PPP loan proceeds cannot be deducted, means that some small businesses may wonder if the PPP was the panacea for their pandemic predicament.

[1] The remaining states either have no income tax or a combination of rolling and static conformity.

[2] On April 15, 2020, the Wisconsin legislature passed, and Governor Evers signed, Assembly Bill 1038, which conforms to certain provisions of the CARES Act, including the tax treatment of PPP loans. The state’s conformity to the rest of the IRC is still 2017.

[3] These dates are current as of the date of this article. It is conceivable that state legislatures have either updated their conformity dates or passed legislation to conform to the CARES Act since publication.

**Originally posted August 31, 2020 – Updated November 3, 2020.

Charles Jeane is an Assistant Chief Counsel for Advocacy whose portfolio includes tax policy. Charles can be reached at Charles.Jeane@sba.gov.

Comments are closed.